The organic fertilizer industry is experiencing unprecedented growth. It is driven by combination of environmental, economic, and social factors. These factors are collectively shaping the Demand Drivers for Organic Fertilizer worldwide. The consumer demand for organic food is transitioning from a niche sector to a core component of modern agriculture. Understanding these powerful demand drivers for organic fertilizer is essential for stakeholders across the agricultural value chain.

Table of Contents

The organic fertilizer market is experiencing remarkable growth. The sector’s 2025 valuations range from approximately USD 7.7 billion to USD 14 billion, and 2026 projections range from USD 8.3 billion to USD 15 billion. It is projected to reach USD 21.40 billion by 2032, growing at a compound annual growth rate (CAGR) of 9% to 13.67%. This growth is increasing because of the global expansion of organic farmland and the core Demand Drivers for Organic Fertilizer, including consumer demand for sustainable crops and regulatory incentives.

Global organic farmland has expanded by 5–9 million hectares since 2023, totaling around 104–108 million hectares. The sector’s evolution from a “niche sustainability play into a central component of modern agronomy” further highlights the Demand Drivers for Organic Fertilizer, signifying a fundamental shift in global farming practices.

Primary Demand Driver 1: Consumer and Corporate Pull

The most direct demand drivers for organic fertilizer originate from the end consumer. Global sales of organic food reached $188 billion in 2024, with the Organic Trade Association reporting sustained double-digit growth since then. Heightened awareness of food safety and the perceived health risks of pesticide residues are prompting consumers to pay premiums of 15-30% for organic produce. This purchasing power cascades down the supply chain. It compels farmers to seek organic certification, for which organic inputs are mandatory.

Simultaneously, corporate sustainability agendas are creating powerful procurement mandates. Major food and beverage corporations are setting Scope 3 emissions targets and entering long-term offtake agreements for low-carbon inputs. For instance, PepsiCo Europe has committed to sourcing low-carbon fertilizers, demonstrating how corporate net-zero pledges are translating into tangible demand drivers for organic fertilizer products.

Primary Demand Driver 2: Regulatory Push and Policy Support

Government policy is one of the critical accelerants among the key demand drivers for organic fertilizer. Stringent environmental regulations are limiting the use of chemical fertilizers in many regions. This is forcing growers into lower-carbon alternatives. Initiatives like the European Union’s Farm to Fork Strategy, which aims for 25% of agricultural land to be organic by 2030, set clear directional targets.

Financial incentives are even more impactful. Governments are giving subsidies and grants to de-risk the adoption of organic practices and lower production costs. The U.S. Department of Agriculture (USDA) injected $116.3 million in 2025 into its Fertilizer Production Expansion Program. Similar programs in the EU, such as Germany’s multi-year risk-reduction packages and Ireland’s transition grants, directly improve the cost economics for both producers and farmers, solidifying policy as a foundational demand driver for organic fertilizer.

Primary Demand Driver 3: The Circular Economy and Technological Innovation

Innovation is transforming the supply and efficacy of organic fertilizers. Circular economy initiatives are turning waste streams like municipal food waste, agricultural residues, and animal manure into valuable raw materials. This addresses waste disposal issues and secures cost-effective raw materials for production.

Advancements in microbial inoculants, biostimulants, and granulation process technology are enhancing nutrient availability and product consistency. New production technologies convert raw organic matter into standardized, pathogen-free granules with improved shelf life and nutrient predictability. This addresses the barriers of inconsistent quality and performance.

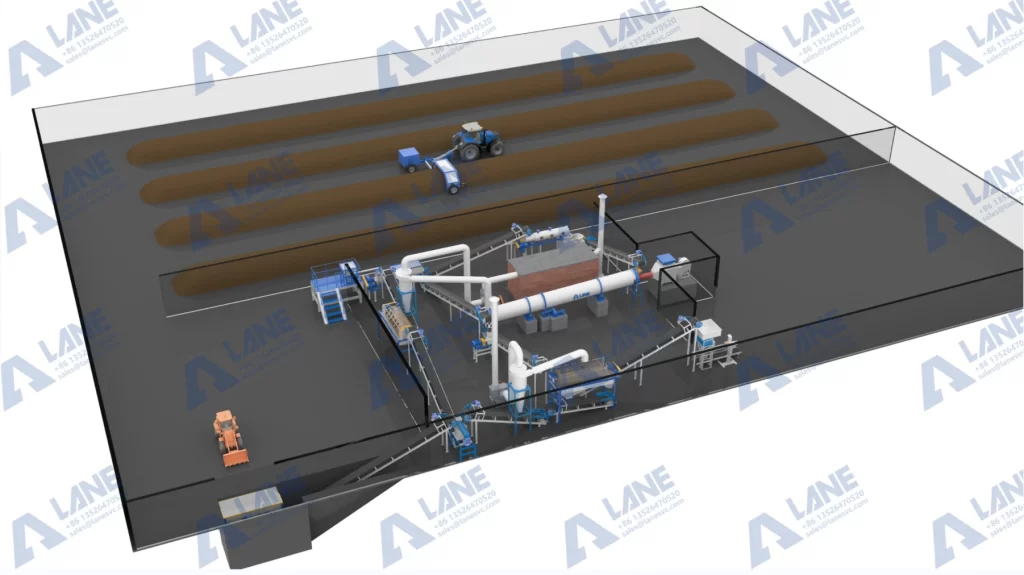

The powerful demand drivers for organic fertilizer create a parallel demand for sophisticated, scalable, and efficient production machinery. LANE Heavy Industry provide essential manufacturing technology that enables entrepreneurs and cooperatives to capitalize Organic fertilizer market. LANE’s equipment is designed to transform diverse raw materials into high-quality, market-ready organic fertilizers.

LANE Heavy Industry’s Key Production Lines:

| Production Line | Key Features & Process | Ideal For |

| PROM Line (Phosphorus-Rich Organic Fertilizer) | Fully automated system from fermentation to packaging. Uses drum, stirring pin or disc granulation. Handles manure, crop residues, phosphate rock. | Producing high-value, nutrient-specific fertilizers for fruits, vegetables, and grains. |

| Liquid Fertilizer Line | Processes food waste, manure, organic waste into liquid formulations. Includes mixing, cutting, and homogenizing units. | Creating soluble fertilizers for fertigation and foliar feeding, suitable for high-value crops and turf. |

| Standard Organic Fertilizer Line | Comprehensive system including composting, crushing, mixing, granulation (stirring or rotary), drying, cooling, screening, and coating. | High-volume production of granular organic fertilizer from a wide variety of organic feedstocks. |

These production lines feature high levels of automation with PLC control systems, environmental protection measures like dust and odor control, and are built with durability in mind, offering models in carbon steel or stainless steel. Designed with the Demand Drivers for Organic Fertilizer in mind, these systems ensure consistent quality, efficiency, and scalability to meet market demand.

The demand drivers for organic fertilizer manifest with different intensity across the globe. This requires tailored marketing strategies.

What are the main challenges holding back the organic fertilizer market?

Despite strong demand drivers for organic fertilizer, challenges remain. Organic formulations can be 30-50% more expensive per nutrient unit than synthetic ones due to more complex production processes. There can also be inconsistent nutrient content between batches, and the logistics of transporting bulky organic materials pose additional hurdles. Understanding the key Demand Drivers for Organic Fertilizer helps businesses focus on high-impact areas to overcome these obstacles.

How does LANE Heavy Industry’s machinery address the issue of inconsistent fertilizer quality?

LANE’s production lines are engineered for consistency. Automated batching and mixing ensure uniform nutrient distribution, while advanced granulation technology (like rotary drum or disc granulators) produces uniformly sized, high-density granules. This results in a professional, predictable product that builds trust with commercial farmers. Such innovations are aligned with the main Demand Drivers for Organic Fertilizer, ensuring that the market receives reliable, high-quality organic products.

Are there production solutions suitable for small to medium-scale operations?

Yes. Providers like LANE Heavy Industry offer customizable production lines. Capacities can be scaled, and lines can be configured to match locally available raw materials, whether it’s livestock manure, crop waste, or municipal compost. This flexibility allows businesses of various sizes to enter the market and contribute to the regional circular economy.

What is the future outlook for the organic fertilizer market?

The outlook is exceptionally strong. With the core demand drivers—consumer preferences, regulatory pressure, and corporate sustainability—only intensifying, the market is poised for sustained long-term growth. Success will belong to producers who can leverage advanced technology to deliver cost-effective, reliable, and high-performance organic inputs.

For more details, please feel free to contact us.

Henan Lane Heavy Industry Machinery Technology Co., Ltd.

Email: sales@lanesvc.com

Contact number: +86 13526470520

Whatsapp: +86 13526470520